23.05.14

Govia wins TSGN franchise, beating FirstGroup

The DfT has awarded the seven-year management contract to run the combined Thameslink, Southern and Great Northern (TSGN) franchise – the largest in the country – to Govia Thameslink Railway Limited.

Govia, the joint venture between Go-Ahead (65%) and Keolis (35%), already operates the Southern, Southeastern and London Midland franchises, and ran Thameslink from 1997 to 2006. The new franchise is being let as a management contract where ticket revenues (an estimated £12.4bn over the life of the contract) are passed directly to the government rather than retained by Govia, due to the complexity and scale of the planned changes to services and infrastructure. But Govia has stated it is committed to delivering these changes and minimising their impacts on customers. Franchise payments from the DfT to Govia amount to an estimated £8.9bn to reflect operating costs and a small margin allowance.

The new contract will help deliver the government’s multi-billion pound investment in the region’s rail network, the DfT says, opening up new routes across London and improving services to scores of destinations, including: Brighton, King’s Lynn, Peterborough, Cambridge, Bedford, Luton, Gatwick Airports and Moorgate.

In addition, nearly 1,400 new Siemens-built Class 700s will be rolled out across the new franchise, providing 50% more capacity and 10,000 extra seats every weekday into central London during the morning peak by the end of 2018, and delivering quicker, cleaner and more reliable journeys for passengers and businesses.

Starting in September 2014, the new management contract, which replaces the Thameslink and Great Northern franchise (operated as First Capital Connect), will encompass the Southern and Gatwick Express routes from July 2015 and also include a small number of services and stations currently operated by Southeastern which will transfer in December 2014. The Thameslink identity will be re-introduced and the Southern and Gatwick Express brands retained.

Rail minister Stephen Hammond said: “The TSGN franchise will play a crucial role in delivering the government’s £6.5bn Thameslink programme. New tunnels will link Peterborough and Cambridge to the existing Thameslink route providing easy access across London via St Pancras to Gatwick and Brighton.”

He added that Govia will order a new fleet of 108 carriages for the Gatwick Express service, replacing the current 25-year-old trains with a fleet better suited to the needs of airport passengers. It will also secure 150 new carriages to replace the 40-year-old trains currently operating on the route between Moorgate, north London and Hertfordshire.

“That means the total number of carriages in service will grow to 2,631 by 2019 – an increase of 27%. It will also release some existing electric carriages to be used elsewhere in the country,” said Hammond.

David Brown, group chief executive of The Go-Ahead Group, said: “This award is testimony to the experience of our people of working in partnership with the DfT, Network Rail and other industry stakeholders and in delivering major integration projects and change programmes.

“Our bid for the franchise was focused on improving customers’ experience and includes two new train fleets for Gatwick Express and Moorgate services, in addition to overseeing the introduction of the Thameslink trains already ordered, as well as delivering improvements at stations.”

As part of the contract, Govia will invest significantly in improving stations, including free wi-fi at more than 100 stations, better retail and catering facilities and improvements to customer information systems. Staffing hours will also be extended so that at more than 100 of the largest stations there will be staff available from the first train in the morning to the last train at night.

Tough new benchmarks for performance, train and station cleanliness and customer service information have also been agreed, however they have not been disclosed. In response to the announcement by the DfT, FirstGroup stated that it is disappointed that it has been unsuccessful in its bid for the new TSGN franchise.

Tim O’Toole, FirstGroup’s chief executive, said: “I am disappointed that we will not be operating the new franchise and taking the Thameslink Programme on to its next stage. We submitted a strong bid which would have delivered high quality services for passengers, value for taxpayers and an economic return for shareholders.

“We are tremendously proud to have operated a significant part of this network over the past eight years through our First Capital Connect franchise, and of the many improvements we have delivered during that time.”

Since 2006, the First Capital Connect franchise has introduced 144 new vehicles onto the Thameslink route delivering an extra 14,500 seats at the busiest times of the day; and increased passenger volumes to 118 million in 2013/14, a 37% increase from 86 million a year when the current franchise began.

Govia's bid also won out over those from Abellio, MTR, and Stagecoach.

In accordance with usual procurement practice, there will be a standstill period of 10 days before the DfT will be in a position to enter into, and complete, the formal contractual documentation and make the award to the successful tenderer.

The government has previously noted that the TSGN franchisee will face tough challenges:

- Deliver services which effectively manage passenger demand throughout the period of reconstruction of London Bridge station;

- Bring into service a new fleet of trains, equipped with new technology, to deliver additional capacity for passengers;

- Manage the integration of other franchises’ services (that is, FCC, Southern and some Southeastern) into this combined franchise;

- Manage the transition in a way that enables the benefits of the Government’s investment in the Thameslink Programme to be fully realised;

- Ensure focus across the whole franchise area whilst supporting delivery of the Thameslink Programme.

Timetable changes will start in December 2014, when London Bridge closes to through Thameslink services until 2018, after which there will be a transition to a peak service of 20tph through central London by May, then a 24tph service in the peak by December once Automatic Train Operation is in place. See RTM’s interview with First Capital Connect’s projects director Ian Duncan-Santiago for more detail on the implementation of ATO.

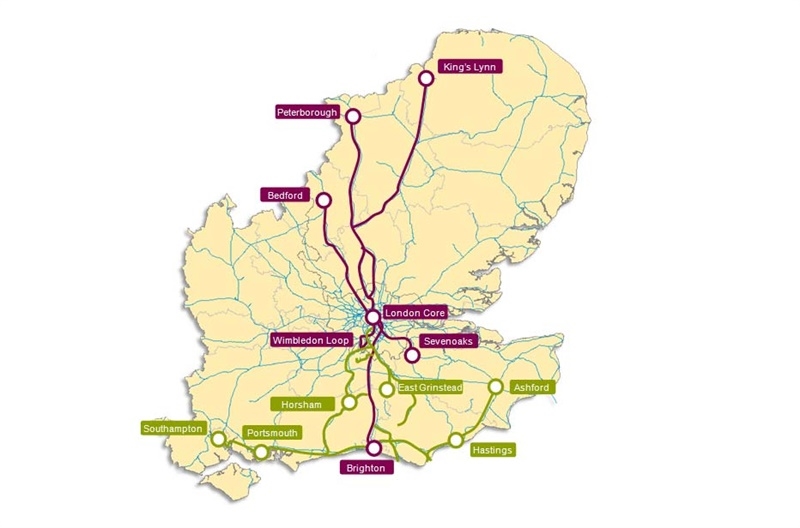

Of the 24tph:

- 16 will run to and from the Midland Main Line (at least six all the way to and from Bedford);

- Eight will run to and from the East Coast Main Line (two serving Peterborough, two serving Cambridge, and four serving Welwyn Garden City or beyond);

- 16 will run via London Bridge (four serving Brighton, two serving Horsham or beyond, two serving East Grinstead, and two serving Three Bridges or beyond);

- Eight will run via Elephant & Castle (four serving the Wimbledoon Loop, two serving the Catford Loop through to Sevenoaks, two serving Maidstone East or beyond as limited stop services via Bromley South).

More detail is available here (pages 37 to 65).

But the DfT says: “Developing the timetables that will operate from 2018 will be a highly complex task. The increase in the number of services operating through the core means that there will be much greater inter-dependency between services operating north of London and those operating south of London.

“For example, decisions about the timetable for the East Coast Main Line will now affect, and be constrained by, the timetable decisions that are taken for the Brighton Main Line. This means that, if the Department specifies highly detailed requirements about the future Thameslink service pattern (for example specifying exactly how many trains must run from each potential origin north of London to each potential destination south of London, or specifying detailed calling patterns for each service), bidders would have little or no meaningful flexibility to develop a set of timetables that maximises overall passenger benefits. On the other hand, too loose a specification presents the risk of not fully securing the anticipated benefits.”

Govia issued this information about the finances:

Revenue and operating profit: From the start of the franchise in September 2014 to June 2015, Govia’s revenue from franchise payments is estimated to be c.£350m. In the first full year to June 2016, which includes the Southern franchise from July 2015, Govia’s revenue from franchise payments is estimated to be c.£1.1bn. Target operating profit margins average c.3% over the life of the franchise including an estimated annual non-cash margin impact of c.1% for IAS 19 (revised) pension costs.

Performance incentives: There are performance regimes in place to incentivise or penalise Govia to meet a range of service quality targets (including for punctuality, customer experience at stations and on trains, and revenue protection). In addition to performance regimes, Govia can also achieve between £nil and £25m for delivery of key performance milestones in the Thameslink Programme, which would largely be payable in the mid-term of the franchise.

Franchise payments: Govia will work with the DfT to generate passenger revenue of an estimated £12.4bn over the life of the franchise for the benefit of the taxpayer. Franchise payments from the DfT to Govia amount to an estimated £8.9bn to reflect operating costs and a small margin allowance. Based on DfT methodology, the net present value (NPV) of the franchise payments is estimated to be around £6.8bn*.

Investment: Govia will procure around £430m of investment over the life of the franchise, including significant investment in rolling stock and franchise improvements. Approximately £40m of capital expenditure will be made by Govia directly, with most of this investment in the first two years. Cash flow: At the beginning of the franchise we expect a working capital inflow of c.£45m in respect of season ticket monies which will be treated as restricted cash. In the year ended June 2015, operating cashflow after capital expenditure is expected to be broadly neutral. In subsequent years cashflow generated should largely reflect operating profit.

New franchise capital requirements and guarantees: Govia will subscribe for £5m of ordinary share capital in cash and provide two contingent subordinated loan facilities for capital expenditure and working capital purposes of £63.9m (unbonded) and £72.5m (50% bonded). There will also be a performance bond (£20m) and season ticket bond. The value of the season ticket bond is dependent on season ticket income and is expected to increase from c.£45m to c.£95m on the integration of Southern. Only the season ticket bond is required to be backed by cash.

Tell us what you think – have your say below or email [email protected]