28.08.15

TOC payments to government leap from £40m to more than £800m

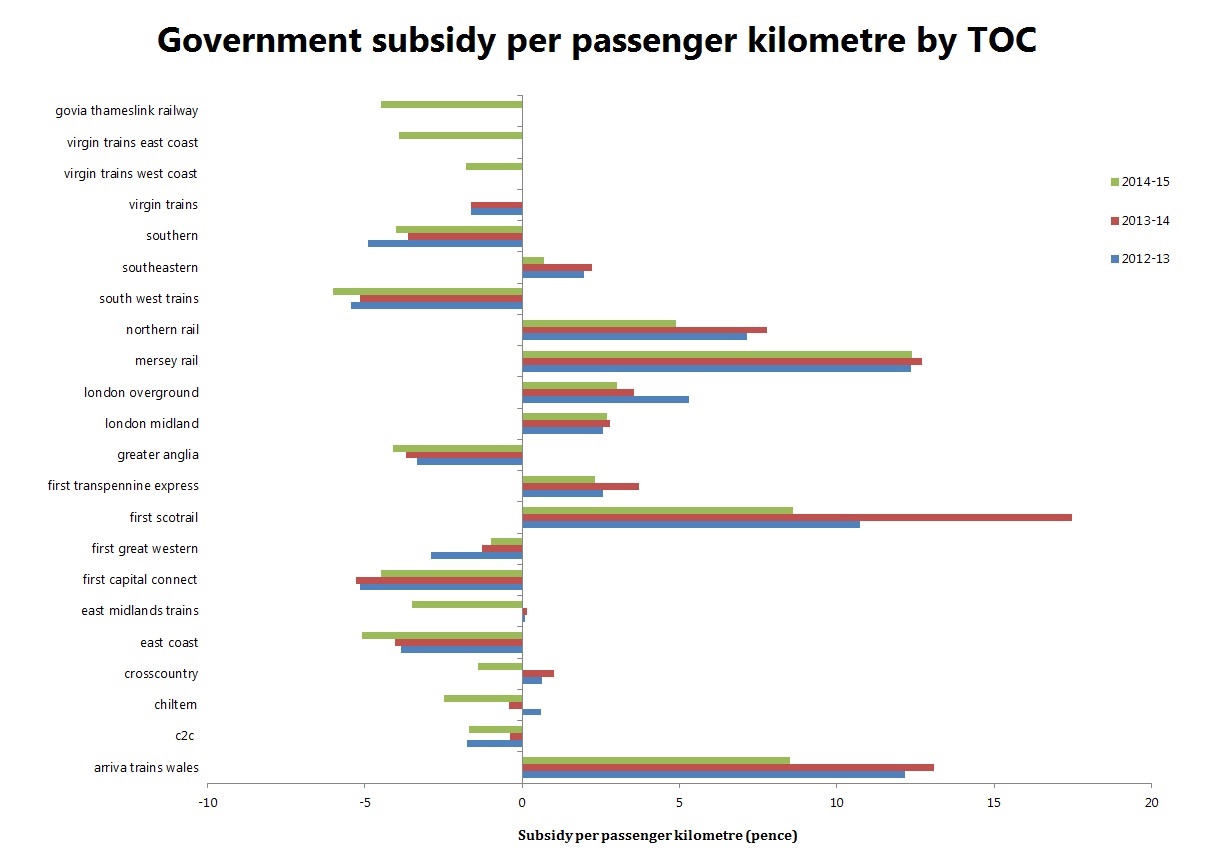

All but two train operators either received less subsidy or paid higher premiums to the government during 2014-15 than the year before, according to new data from the Office of Rail and Road (ORR).

The overall amount paid to government by the operators, minus subsidies, leapt up from a net figure of £40m to £802m.

Data released yesterday (August 27) shows a positive trend in the amount of subsidy payments being granted to companies, with Arriva Trains Wales, ScotRail and Northern Rail presenting marked contrasts from previous years.

Arriva Trains Wales received payments equivalent to 8.5p per passenger km, compared with 13.1p in the previous year.

Northern Rail was paid the equivalent of 4.9p per passenger km, down from 7.8p in 2013-14.

ScotRail received 8.6p of subsidy per passenger km compared with 17.5p the previous year and 10.7p in 2012-13. However, it still received the highest subsidy payment of any franchised operator, totalling £261m.

Though London Overground, London Midland and Merseyrail also required less government subsidy this year, their figures were only marginally different from payments in previous years. Payments to London Overground and Merseyrail are both classed as 'contracted grant payments', as they are not part of the national DfT franchise system.

Merseyrail received by some way the highest subsidy per passenger km, at a whopping 12.4p, though this amounted to less money than that given to ScotRail – and a reduction of 2.3% from the previous year.

Other operating companies that received less included First TransPennine Express (since replaced by GTR) and Southeastern, which is now receiving subsidies equivalent to less than a penny per passenger kilometre.

Most operators that pay a premium to the government paid more in 2014-15 than the year before, including c2c, CrossCountry, East Coast, Greater Anglia, South West Trains and Southern.

Chiltern and East Midlands Trains are paying significantly more money to the government: 2.5p and 3.5p respectively per passenger kilometre, up from 0.42p and 0.16p the previous year.

However First Capital Connect and First Great Western stood out as the only two companies with poorer performance in 2014-15, having paid less premium to the government than in previous years.

Overall, the government received 1.3p per passenger km in 2014-15, with the trend of regional operators receiving a subsidy while those in the long distance and London and south east sectors paying a premium having continued this year.

Figures are calculated from the net payment to or from the government and their total passenger km.

This is the fifth year running in which the government has received more in premium than it has paid out in subsidy.

Click on the graph to see a bigger version. Negative figures indicate a premium paid, rather than subsidy received.

Click on the graph to see a bigger version. Negative figures indicate a premium paid, rather than subsidy received.

Among the passenger transport executives (PTEs), Transport for Greater Manchester received the largest subsidy – £48.2m – followed by Metro (West Yorkshire) with £43.2m. These payments are for the rail services each of the PTEs purchase from Northern Rail.

Grants to PTEs were £59m smaller than in the previous year, with each PTE experiencing a decrease in payments of between 20% and 40%.

Private investment in the rail industry increased remarkably in 2014-15, skyrocketing to £647m – a 53% increase on the previous year (51% when re-based on current prices).

Investment in rolling stock has increased steeply to £715m, more than double the private investment in 2013-14.

On the other hand, investment in stations saw an apparent dramatic drop, primarily because of the net sale of £128m of station assets last financial year. This marks the first time that the disposal of station assets exceeded station investment since calculations began in 2006-7, when private firms were investing £155m in station developments.

Overall government support to the rail industry amounted to £4.8bn, a decrease of 9% from 2013-14 (or 11% in real terms).

Most of this – £3.8bn – went on ‘direct rail support’: the grant payment to Network Rail. This was partially offset by the £802m of net premium payments received from train operators.

A spokesman for the Rail Delivery Group, which represents Network Rail and train operators, said: “There is more to do to improve services but the finances of the railway have been transformed in the last two decades by phenomenal passenger growth and sustained public investment in improving tracks, signals and stations. By carrying record numbers of passengers, the rail industry is generating more money, helping to reduce government support and sustain the biggest programme of investment in the railway for generations.”

(Top image c. Alvey & Towers)