12.06.13

ORR suggests cut of £2bn to Network Rail’s CP5 delivery plans

The ORR has said Network Rail should deliver its plans for CP5 for £2bn less than it had wanted.

In its Strategic Business Plan (SBP), Network Rail proposed spending £40.1bn on running and expanding the railways from 2014 to 2019, but the ORR, after extensive analysis, says the cost should be £37.9bn.

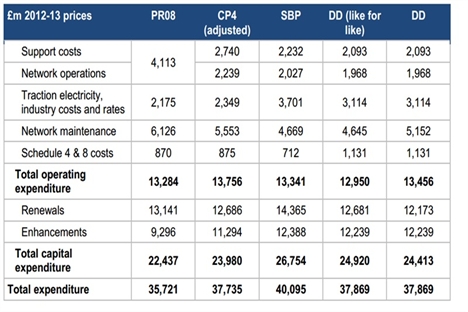

The table above sets out CP4 spending (column 1), Network Rail’s proposal (column 2), and the ORR’s draft determination today (column 3).

The ORR says that savings can be made through better use of new technology, more efficient ways of working and better management – but not at the expense of safety.

Network Rail has said the ORR draft determination “needs careful and detailed thought” before it gives its formal response in September. A spokesman said: “Getting the balance right in making the choices between performance, growth and value for money is critical if we are to build on efficiency savings of around 40% achieved over the last two control periods.”

ORR chief executive Richard Price said: “This determination is stretching but achievable and it gives Network Rail incentives to build on past successes, and do even better than the challenges we have set.”

The ORR has criticised aspects of Network Rail’s submission, saying “a number of documents were submitted late and with significant inconsistencies”, but said overall the organisation had made “much more realistic assumptions about the cost reductions that could be achieved” compared to CP4.

The ORR said it had “largely protected Network Rail’s maintenance expenditure so that the delivery of a high-performing railway is not compromised”, while suggesting additional funding for civils upgrades and level crossings improvements and closures.

The ORR’s assessment suggests the day-to-day operational cost of running the network for CP5 should be £21.4bn.

It has proposed “tougher” regulatory targets, and although the overall 92.5% target for the trains of trains arriving on time remains, it wants the difference between the best and the worst performing routes narrowing by the end of CP5, and at least nine out of ten trains must run on time on every individual route. It will also hold Network Rail to account for its asset management.

The main £12bn enhancements programme has been approved – some money was taken out of the budget, but thanks to some additional funding then added in by the ORR, the total amount nearly matches Network Rail's SBP request. However, the ORR wants to see better-developed plans before it releases funds for those still in the early stages of planning, which amounts to nearly £7bn worth of projects.

The ORR has approved £67m of funding to upgrade and close level crossings in England and Wales.

It said it is “expecting Network Rail to deliver a further 20% efficiencies” in CP5, meeting the McNulty efficiency challenge. But it says: “We have also carefully considered the lessons of CP4. When Network Rail tried to make efficiency savings in maintenance in CP4, it did not manage the change well in some respects. We have reduced the level of efficiency improvement required at the start of the control period for maintenance compared to Network Rail’s SBP to give the company more time to plan the necessary changes and implement them effectively. Effective delivery is essential if longer term efficiency gains and service quality improvements are to be secured and locked-in for the future.”

On access charges, the ORR said that in real terms, average total freight charges will increase by around 21% on current levels by 2018-19, equivalent to 4% a year average, and it estimates that average total franchise passenger variable charges and open access variable charges will each increase by 1% from CP4 to CP5 in real terms.

This table shows a summary of the ORR’s expenditure assumptions compared to PR08, forecast CP4 outturn (adjusted to make it more comparable to this determination) and Network Rail’s Strategic Business Plan:

The ORR does not ignore the growing problem of Network Rail’s debt mountain, nor the cost of servicing it. It notes: “Network Rail’s debt is forecast to rise from £30,242m at the end of 2013-14 to £40,118m by 2019, although its assets will also grow in value. The rise in debt largely reflects the funding of renewals and the large enhancement programme. We forecast that Network Rail will spend on average around £1,200m a year servicing the debt in CP5. Under reasonable assumptions debt could continue to rise in future control periods and there will need to be a debate within government and the industry about how sustainable this is.”

ATOC called today’s announcement “an important opportunity to incentivise Network Rail and operators to work more effectively together, allowing the industry to build on current near record levels of customer satisfaction and meet growing passenger demand by providing better trains, more seats and quicker journeys”, but the RMT union angrily dismissed the plans. Its general secretary Bob Crow said: “Cuts on this scale would drag us right back to the grim days of Railtrack and the tragedies of Hatfield and Potters Bar. RMT is making it clear this morning that any threat of compulsory job losses at Network Rail would lead to preparations for a national strike ballot.”

The key upcoming dates:

4 September 2013: Deadline for responses to the draft determination

31 October 2013: ORR publishes the final determination

December 2013: Network Rail publishes draft CP5 delivery plan for consultation

March 2014: Network Rail publishes CP5 delivery plan

1 April 2014: CP5 begins

To read the ORR’s draft determination and summary overviews, visit: http://www.rail-reg.gov.uk/pr13/consultations/draft-determination.php