17.12.15

Network Rail asset sell-off could hit devolution plans – TfGM

Transport for Greater Manchester (TfGM) says Network Rail’s plans to sell off £1.8bn of non-core assets to meet the rising costs of its enhancement programme could “impact on plans for development and devolution”.

In a paper to be presented to the Greater Manchester Combined Authority (GMCA) this week, TfGM said it will be “seeking assurances from Network Rail that land and property sold will not impact on our ability to future proof transport expansion or impact on the commercial viability of our devolution aspirations”.

The report stated that this is particularly relevant for rail stations devolution where “future income and development opportunities could be constrained”.

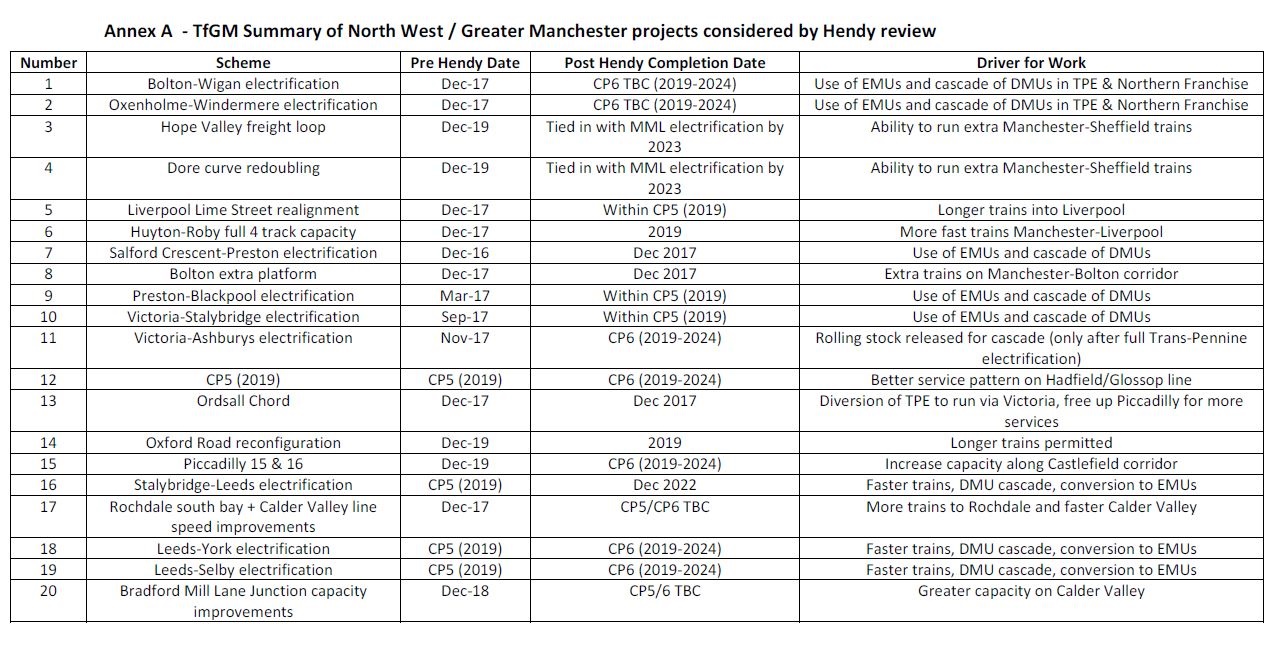

The headline of the Hendy review is that no infrastructure schemes have been cancelled, and most schemes planned for CP5 (2014-2019) will be delivered by 2019, albeit some will be delivered later than planned, or pushed into CP6.

TfGM stated that all but two projects required to support the new Northern and TransPennine rail franchises are to be completed as planned during CP5.

“Bolton to Wigan and Oxenholme to Windermere electrification will however be delayed into CP6 (2019-2024),” the report reads.

“The retention of diesel trains on these two particular routes will mean a continued crowding problem on services into Greater Manchester due to the lower capacity of the retained trains compared to replacement electric trains. In addition there will be a delay to the release and cascade of approximately ten diesel rolling stock units which will delay the resolution of overcrowding issues on other routes. TfGM will be undertaking work with Network Rail and the incoming Northern Franchisee to understand the route by route implications.”

But TfGM also noted in a summary of north west/Greater Manchester projects being considered by the Hendy Review that out of 20 schemes, 17 will be delivered later than planned.